Loyalty Program Examples: Expedia Group launches One Key

Overview

One Key, Expedia Groups’ new loyalty program, is designed to knit together their three main...

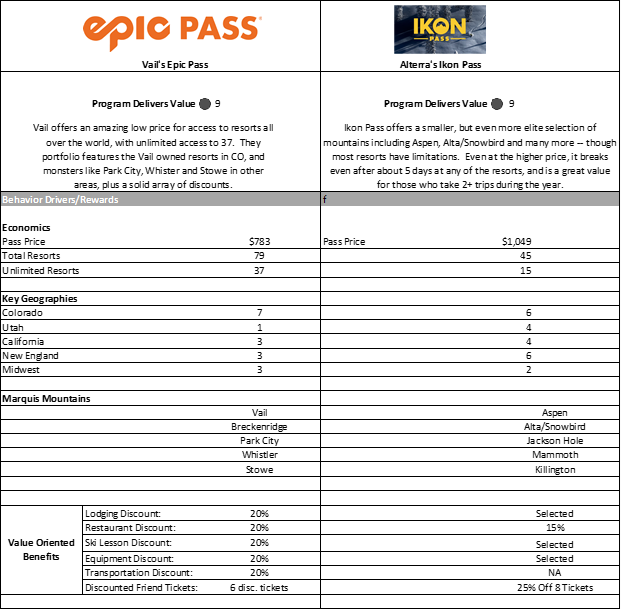

Subscription is a new frontier in loyalty programs that’s been carved out so famously by Amazon Prime. However, over the last few years an exciting battle has emerged in the alpine ski industry between Vail Associate’s Epic Pass and Alterra Mountain’s Ikon Pass. While the lines between product and loyalty program get blurry in this space, it’s clear to me that the aim of these programs is loyalty: retention, cross-sell and maximizing share of wallet – just like it is for Amazon. So, while not a rewards program per se, subscription is certainly an avenue to be explored by marketers with these objectives. This article looks at these two competitors through the LoyaltyLevers lens and provides insights that can be applied to any category.

Just as Amazon Prime has changed the face of ecommerce, the Epic and Ikon passes have changed the complexion of the ski industry, pitting elite pairings of the most famous resorts against each-other in this high-stake battle.

These pass programs are a subscription product because they offer access to skiing for a fixed price for each season. Both programs offer a large network of participating resorts, with a mix of participants who offer unlimited or limited access (5-7 days per year at the resort)) – all at about the same price as a season pass at one of the resorts.

For those who frequent a mountain with unlimited access, the passes are a no-brainer because they offer a no cost way to take an extra ski vacation or two, cross-selling within each of the networks at very little additional cost to the ticket. However, the big advantage to the ski areas are the lodging and ancillary charges that come with the traffic – these can easily double the revenue and profit. Each program offers discounts to use the resort lodging, dining, ski rentals and lessons.

The influx of additional traffic does not go unnoticed by the locals however, who resent the influx of traffic that clutters their experience, especially since many are beginning skiers.

Due to their high-profile resort participants, the Ikon Pass in particular is a good solution for less frequent skiers, because even though most resorts have usage limitations, the cost of the pass is less than a 7 day ticket at just one resort. So, the pass has a similar effect for those who may have historically taken a single ski vacation per year, encouraging them to perhaps try another resort for a long weekend.

Another key aspect to these passes is the perceived added value and positive retention impact. In an age where global warming is starting to impact the snow and quality of experience, the resorts face a real risk of a shrinking customer base. With a declining experience and day tickets at most resorts costing $200 or more, the industry would be pricing itself out of existence.

Both programs offer good value, rating a 9 – however they do it very differently. Vail, with many more owned mountains, uses this pass as a way to cross sell their portfolio, and offers a very attractive price point. Ikon Pass is a way for Alterra to compete against the Vail offering, by sprinkling in an offering of more attractive Marquis mountains (they only own one of the top 5 marquis mountains). By stepping more out of their owned network, their price point naturally needs to be higher, which means their clientele will be more select. Most importantly, these passes force the customers to choose, and there is an ever increasing and high stakes battle between the two coalitions.

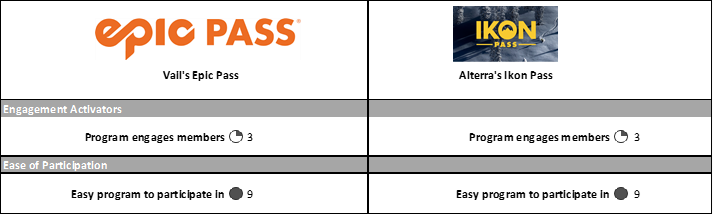

These two programs do surprisingly little to build true loyalty among the members. Ikon Pass tries harder to connect at the lifestyle level with things like the conservation partnerships Protect our Winters, and off-season activities at the various resorts. The Ikon Pass app also strives to build community by building a profile so that you can track and meet your friends on the mountain. The Epic Pass offers Epic Mix, which focused more on user generated content.

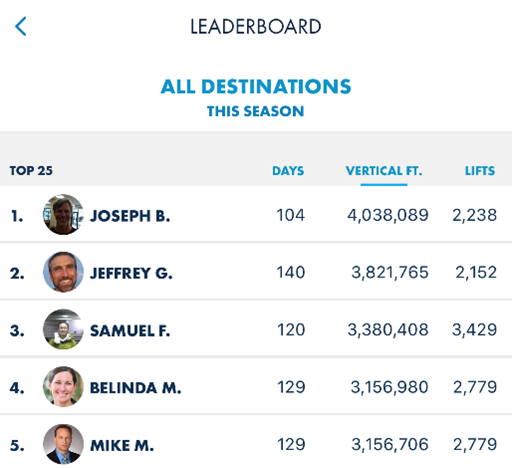

There is little evidence of personalized communications, nor recognition based on usage. This may be since many of the participants are separate businesses, knitted together in a somewhat tenuous coalition, however it is a missed opportunity. At a minimum, each of the resorts is tracking visitation and lift rides with the scans, so they know how many vertical feet each skier has conquered. For app users, they know much more about trails used, speed, etc. Ikon Pass does offer leaderboard functionality, with an ability to create custom boards.

Otherwise, these is no gamification, status leveling or even simple recognition. Especially with issues between locals and passholders flaring up, more needs to be done in this arena.

There is also a significant missed opportunity to leverage the visibility and buying power these programs have into complementary value-added packages and experiences that could be developed. Special packages from travel partners like airlines and car rental providers to add value all around the vacation experience.

Engagement Activators & Ease of Use

Most communications relate to pass renewals, opening countdowns, functional requirements supporting mountain operations, or cross sells for lodging discounts. Again here, the pass programs appear secondary to the relationship that each individual resort is striving to make with their visitors. In some cases, there are overlapping loyalty programs offered by each individual mountain – even within the same Alterra or Vail owned resort groups!

There is a great opportunity to leverage the wealth of data to create compelling communications ranging from real time personalized communications and promotions on the mountain, to appealing promotions to drive cross-usage during the season and content that embraces different aspects of the lifestyle off-season.

From an ease-of-use perspective, the programs are at parity -- each of the passes operates seamlessly and is simple for the member to use. Activating at each of the participating mountains is automatic when you ride the first lift there. Fraud prevention is in the background, and doesn’t hinder the ski experience.

Loyalty Levers Take

While both Pass products are designed with intricate detail to support their participating partners from an operational perspective, the brand that ultimately wins will be the one that is able to truly tap into sentiment builders and make the pass holders feel welcomed and appreciated.

Due to the uneasy alliances between competing mountains, the app will need to be the unifying factor, with must-have features that will entice skiers to download and use it as part of their ski experience. App usage will grow with the following kind of benefits, which only serve as thought starters:

The possibilities are endless, and will act to not only improve passholder retention, but also to forge stronger bonds among the mountains themselves, which result in better long-term partnerships. Further, the enriched programs will naturally provide increased opportunities for Engagement Activation.

One Key, Expedia Groups’ new loyalty program, is designed to knit together their three main...

Loyalty program partnerships can dramatically increase the relevance and appeal of loyalty programs for any...

Comments